India's First FinTech Startup Simplifying Provident Fund Challenges for India's workforce

Jan 09, 2025

India PR Distribution

Borivali, Mumbai (Maharashtra) [India], January 9: Launched in October 2023, FinRight Technologies, a Mumbai-based fintech startup founded by CRED and Amazon professionals, addresses personal finance challenges uniquely. With a vision to address some of the most challenging pain points in personal finance, FinRight has chosen Employee Provident Fund (EPF) as its first major focus area as accessing this retirement corpus has become increasingly complicated.

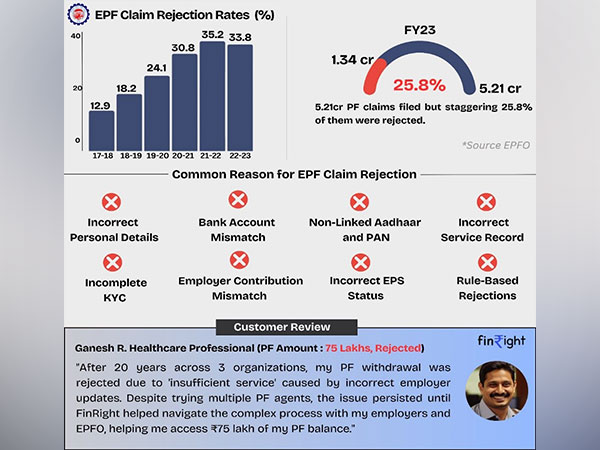

In FY23, over 5.21 crore PF withdrawal and transfer claims were filed, but a staggering 25.8% of them--around 1.34 crore of PF claims--were rejected. For final PF withdrawal claims, the PF claim rejection rate hit a five-year high of 34%. These numbers reveal the deep-rooted challenges employees face when dealing with their Provident Fund claims, making it one of the biggest financial hurdles in India today.

Since its launch in 2023, FinRight has assisted over 5,000 customers on their PF withdrawals and online PF claims, offering a unique combination of tech-driven and human support around intricate rules and processes to provide personalised guidance and assistance. Individuals seeking to withdraw their EPF or resolve issues with EPF transfers can now turn to FinRight for seamless support. By visiting www.finright.in, users can access expert assistance powered by FinRight's cutting-edge platform. The fintech startup ensures that EPF withdrawal requests initiated through its platform receive dedicated attention, significantly reducing the risk of rejection and simplifying the process for India's workforce.

"Most people find understanding rules & processes around PF transfers and PF withdrawals daunting. The market is crowded with unorganized PF agents and PF consultants who lack expertise, provide inconsistent service, and often charge exorbitant fees. We saw an opportunity to deliver professional, transparent, and affordable solutions to simplify Provident Fund claims for everyone. Our goal is to empower individuals to access their money without stress or delays" said Amey Kanekar, Co-founder of Finright Technologies Pvt. Ltd.

FinRight is gearing up to introduce digital automation to tackle EPF issues seamlessly by integrating EPFO APIs and employing AI, the founder revealed. "8/10 people discover problems with their EPF only when they need funds, and that's a challenge we aim to address head-on," he said. As part of this initiative, FinRight will soon launch a "Get Your EPF Reviewed" online service, empowering users to identify discrepancies instantly in their EPF accounts with just a few clicks.

FinRight's impact is best demonstrated through the experiences of its customers, who have successfully navigated complex online PF withdrawals issues with the platform's help:

* Vikas K., Tech Professional in Delhi: "After leaving a tech company where I worked for eight years, I struggled to withdraw my Rs37 lakh EPF due to a mismatch in my father's name and errors from a subsidiary transfer. My claims were rejected 16 times. FinRight stepped in with a joint declaration and rigorous follow-ups with EPFO, resolving the discrepancies and enabling a successful PF withdrawal within a month. Their expertise in handling Provident Fund withdrawal was a huge relief."

* Ganesh R., Healthcare Professional in Chennai: "After 20 years across 3 organizations, my online PF withdrawal claim was rejected, citing 'insufficient service.' This PF claim rejection occurred because the employer had failed to correctly update my service. Despite seeking help from multiple PF consultants and PF agents, the issue persisted. That's when FinRight came to my rescue. They helped me navigate the complex process between employers & EPFO, ensuring my service records were updated. This enabled me to access Rs75 lakhs of my PF balance"

Angel Funding:

FinRight, driven by its mission to simplify personal finance challenges, has secured seed funding from investors. The startup aims to broaden its offerings to tackle additional personal finance pain points, including insurance claims, taxation, and estate planning. Simultaneously, it plans to scale its operations to major Indian cities, reinforcing its position as a trusted leader in financial assistance and provident fund services

(ADVERTORIAL DISCLAIMER: The above press release has been provided by India PR Distribution. ANI will not be responsible in any way for the content of the same)